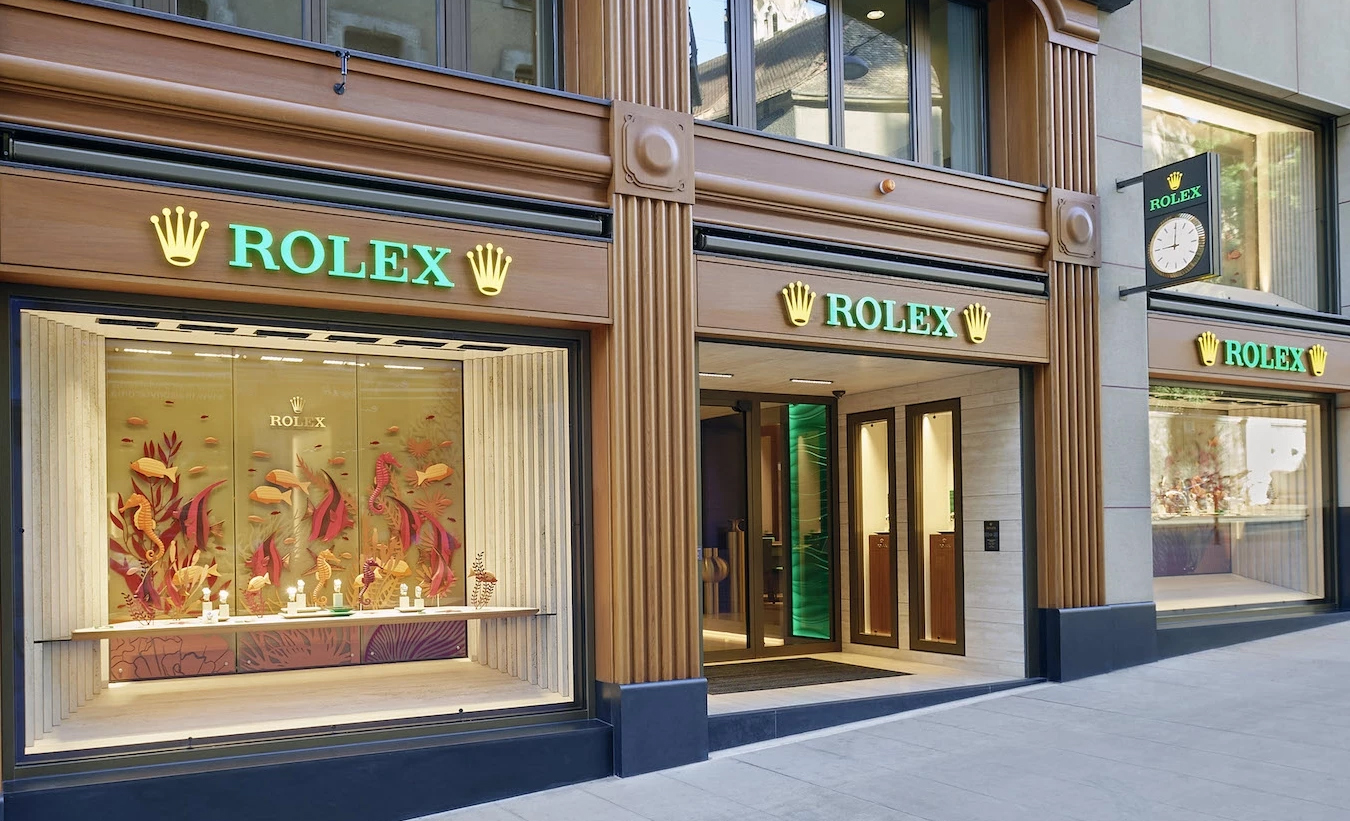

Aside from its directly-run boutique in Geneva, Rolex does not run stores and does not sell direct to consumer online either.

That changes when its deal to acquire Bucherer is waved through by Switzerland’s competition authorities.

From that point, at the very least, it will be profiting from a network across Europe and the United States of over 100 stores and one of the most successful luxury watch ecommerce businesses in the world.

Rolex has said Bucherer’s management will continue to run the retail operation at arm’s length, but that does not mean Rolex will not be learning from every move Bucherer makes.

This is mystery shopping on steroids.

Change is likely to be imperceptible, at first, but the more Rolex learns about retail, the more powerful it will become.

This does not necessarily mean it will replace or even meddle more in the businesses of its global network of over 1,000 authorized dealers.

It might mean the opposite.

When Rolex better appreciates the specialist skills and local customer relationships its retail partners bring, it might well back them even more.

It may well be that it discovers weaknesses in retail groups running 100 stores versus family-owned independents with a few stores deeply embedded in their local communities.

Whichever way Rolex heads in the coming 5-10 years, I do not see it getting easier for the chasing pack of watch manufacturers to close the gap on the $10 billion behemoth.

Whichever way the likes of Omega and Cartier turn, Rolex has an answer, including in the emerging market for directly-run certified pre-owned programs by brands; a program already being piloted by Bucherer and Rolex.

That might make pre-owned specialists nervous.

Tim Stracke, CEO of Chrono24, sees Rolex taking more control of the second hand market.

“Do we I expect any relevant changes in the industry within let’s say 3 years? No,” he says. “Do I expect changes within 5-10 years? Definitely. Rolex will use Bucherer to have more control over their CPO business and better control supply and sales into the grey market.”

Paul Altieri, CEO of Bob’s Watches, believes the biggest changes will be evident in the primary market where the combination of Rolex and Bucherer would be a stepping stone to challenging the biggest luxury brands in and beyond the watch business.

“The recent acquisition of Bucherer by Rolex is an intriguing move in the luxury market landscape. The opportunity is rife with the potential rebranding of these storied watch and jewelry outlets under the iconic Rolex moniker. Should Rolex indeed opt for this branding strategy (and I’m not saying they will do so immediately), it would brilliantly align with the steps taken by other luxury juggernauts like Cartier, Tiffany, and Van Cleef & Arpels. By doing so, Rolex not only reaffirms its dominance in the luxury watch sector but also presents an opportunity to offer an enhanced, immersive brand experience for its discerning clientele,” he suggests.

This just reaffirms that only large market customers will be able to find watches at retail prices. The rest of us will still be buying in the grey market at grossly inflated prices.

Still cant buy any Rolex at retail price from a AD, what is the point?, I would like a submariner in my collection, but I wont pay above retail, why the hell should I.

I will stick to my Omegas and Tudors, better value for money.

I will never buy above retail. Even if I have to pass rolex